09-06-2024

TAIPEI/ BEIJING: Ozempic is big business in China.

Last year, the Danish pharmaceutical giant Novo Nordisk doubled its sales of the diabetes drug in the country to almost $700m, 5 percent of Ozempic’s global sales.

Ozempic was approved in China to treat diabetes in 2021, but it has been its anti-obesity ingredient, semaglutide, that has fueled demand for what many Chinese refer to as the “internet celebrity weight-loss drug”.

Chinese female influencers and vloggers have promoted the use of Ozempic on Chinese social media.

Chinese female influencers and vloggers have promoted the use of Ozempic on Chinese social media.

The same platforms are also the birthplace of a number of “beauty challenges” that have gained traction over the years where mostly young females display their thinness.

“Overall, ‘thinness’ is the beauty standard for women in China, and some are even willing to demonstrate it and pursue it to the detriment of their health,” Pan Wang, a senior lecturer in Chinese and Asian studies at Australia’s University of New South Wales, told media.

For Wang, the surging demand for Ozempic is no surprise.

“Many people in China are willing to try all kinds of methods and supplements to lose weight these days,” she said.

Those desperate to lose weight at almost any cost are not limited to young, beauty-conscious women on social media.

China has the largest number of overweight or obese people in the world, with about half the population carrying excess weight.

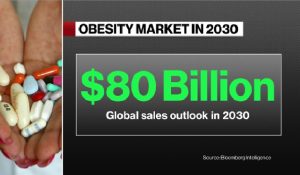

Rising rates of obesity, combined with demanding beauty ideals, make the Chinese market an enticing prospect for the makers of drugs like Ozempic, Wang said.

“There is potential for a lot of money to be made.”

Pharmaceutical companies have not been sitting idle.

Novo Nordisk has applied to China’s drug regulator to expand the use of Ozempic amid speculation it hopes to gain approval to market the drug specifically for weight loss. The company expects its drug Wegovy, which is explicitly intended for weight loss, to be approved for sale in China this year.

In May, Indianapolis, Indiana-based pharmaceutical company Eli Lilly received approval from Chinese regulators for its Ozempic rival, Tirzepatide.

In May, Indianapolis, Indiana-based pharmaceutical company Eli Lilly received approval from Chinese regulators for its Ozempic rival, Tirzepatide.

China’s Hangzhou Jiuyuan Gene Engineering, owned by pharmaceutical behemoth Huadong Medicine, earlier this year applied for approval to sell the first homegrown rival to Ozempic.

Despite these developments, the demand for weight-loss drugs has outstripped supply, with Eli Lilly expecting demand to outpace supply in 2024, as well.

On Chinese e-commerce platforms like Taobao, the price of Ozempic has risen as high as 1,000 yuan ($138), twice the cost of the same drug at a public hospital.

While established companies are working with Chinese health authorities to increase supply, the sale of counterfeit versions of semaglutide products has surged on the Chinese internet.

“The grey market for weight-loss drugs has been booming in China,” Allan Von Mehren, chief analyst and China economist at Danske Bank, told media.

“Weight-loss drugs fall within a market with massive growth potential in China.”

Von Mehren said the rising demand means that competition between suppliers will not be a major obstacle in the coming years.

“Instead, the limitation right now is the capacity,” he said.

“Whoever can invest in capacity and dominate capacity will probably be the ones that eventually claim the biggest slice of the market.” (Int’l Monitoring Desk)

Pressmediaofindia

Pressmediaofindia