11-06-2025

Bureau Report

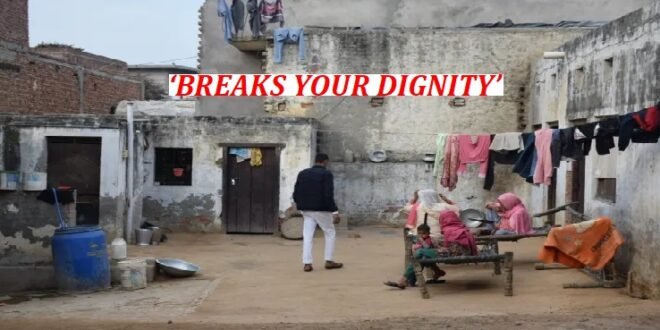

NEW DELHI/ MEERUT: The last of the paint had begun to peel off Mohammad Mohsin’s house two years ago. The faded green, white and yellow paints on the walls still bore stains from last year’s monsoons.

A narrow, 3-foot-tall (0.9 metres) passage only possible to enter by crouching, led from the kitchen into a courtyard lined with buffalo dung, a rusting scooter, and a creaking cot in northern India’s Meerut district, about 100km (62 miles) from New Delhi.

“We will get the house painted when it’s finally wedding time,” Mohsin had said, leaning on an iron shovel, when Al Jazeera visited him in February earlier this year, referring to his sister Aman’s wedding plans but the date for the wedding came and went without it being solemnized.

“We will get the house painted when it’s finally wedding time,” Mohsin had said, leaning on an iron shovel, when Al Jazeera visited him in February earlier this year, referring to his sister Aman’s wedding plans but the date for the wedding came and went without it being solemnized.

In 2023, Mohsin had borrowed roughly $1,440 under the Indian government’s Kisan Credit Card (KCC) scheme. “Kisan” means “farmer” in Hindi.

Launched in 1998, the KCC initiative is intended to modernize rural credit by providing accessible, short-term, low-interest credit to farmers for agricultural expenses, thereby replacing exploitative private moneylenders.

Issued against land holdings, the KCC operates like a revolving credit line, allowing farmers to borrow at the start of a crop cycle and repay after the harvest. With a modest interest rate of 4 percent annually, the scheme is among the most accessible financial instruments for millions of farmers but for years now, the KCC scheme has deviated from its original purpose. Farmers in rural India, where agriculture barely sustains families and where dowry in marriages is the norm, have used KCC loans as a convenient but dangerous alternative to family income.

The KCC money Mohsin borrowed in 2023 from a state-run bank’s local branch was not meant to sow sugarcane or buy fertilizer. He always meant to use it for his sister’s dowry: Aman’s prospective in-laws had demanded a Maruti Wagon-R car, a larger Mahindra Scorpio SUV, and hundreds of thousands of rupees in cash, when the marriage was planned.

KCC looks and can be used like a regular credit card, including for cash withdrawals. Clutching the family’s KCC card issued in his father Mohammad Kamil’s name, Mohsin withdrew the money from an ATM and went straight to a car dealer in Meerut to make the down payment for a Wagon R car.

KCC looks and can be used like a regular credit card, including for cash withdrawals. Clutching the family’s KCC card issued in his father Mohammad Kamil’s name, Mohsin withdrew the money from an ATM and went straight to a car dealer in Meerut to make the down payment for a Wagon R car.

In February 2025, Aman’s proposed marriage collapsed under a new set of dowry demands. By now, Mohsin was already in significant debt and had no money to sow crops, or invest in seeds or farm machinery.

He was also saddled with the car he had bought for the groom. He missed paying the monthly instalments a few times. When farmers fail to repay during a crop cycle, the interest rate jumps from 4 percent to 7 percent, which is what happened with Mohsin.

He now repays the loan in small instalments, but knows that he will be playing catchup for years. And the longer he delays his payments, the higher the risk that the loan could be classified as a non-performing asset (NPA), damaging his credit rating and future borrowing capacity.

Meanwhile, 22-year-old Aman finished Fazilat, a seven-year course in Islamic theology offered by Darul Uloom, a prominent Muslim seminary in Deoband, about 80km (50 miles) from Meerut. The course is considered the equivalent of a bachelor’s degree from a regular college.

Aman’s family has also resumed its search for another groom. “I will get married when the right family agrees,” Aman told media.

Pressmediaofindia

Pressmediaofindia