17-12-2024

Bureau Report + Agencies

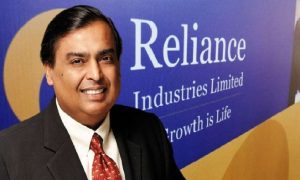

NEW DELHI/ MUMBAI: India’s Reliance Industries, opens new tab said on Friday it has bought a 74% stake in an industrial area developer, situated in the country’s financial hub of Mumbai, for 16.28 billion rupees ($192 million).

Navi Mumbai IIA was renamed from Navi Mumbai Special Economic Zone after the state government approved to convert it into an integrated industrial area in 2018.

The deal comes at a time when the warehousing market heats up in the country, with industrial park operators facing a spike in demand as growth in Asia’s third-largest economy remains steady and more companies look to India in their bid to diversify supply chains away from China.

The deal comes at a time when the warehousing market heats up in the country, with industrial park operators facing a spike in demand as growth in Asia’s third-largest economy remains steady and more companies look to India in their bid to diversify supply chains away from China.

Reliance, according to its latest annual report, opens new tab, already owns units focused towards warehouse and logistics. The latest deal would add heft to the Mukesh Ambani-owned conglomerate’s operations that range from energy and telecom to retail.

The City and Industrial Development Corporation of Maharashtra would own the remaining 26% stake in NMIIA.

For the fiscal ended March 2024, the industrial area developer recorded a turnover of 348.9 million rupees, up 6% over the year earlier.

Land is getting hard to find in a sprawling industrial park in southern India where workers are scrambling to build modern new warehouses and factories for companies betting on the country’s economic boom or diversifying their supply chains beyond China.

“It is one of the most wanted places in India for European and American companies,” said S. Raghuraman, an official of the Greenbase industrial park, near plants run by Apple supplier Foxconn, opens new tab and truckmaker Daimler, opens new tab.

Inquiries for leasing space in the park, run by Blackstone, opens new tab and real estate tycoon Niranjan Hiranandani, have gone through the roof, he added.

“We are in talks with at least three clients looking to shift their base from China.”

To meet the burgeoning demand, Greenbase aims to invest $800 million to quadruple its industrial park space to 20 million sq ft (1.9 million sq m), a target it revealed for the first time.

To meet the burgeoning demand, Greenbase aims to invest $800 million to quadruple its industrial park space to 20 million sq ft (1.9 million sq m), a target it revealed for the first time.

That is just the latest sign of a rush for leased warehouse space that peaked in the last quarter of 2023 at its highest in two years, says real estate firm Colliers, as India’s economic growth of more than 8% outstrips advanced nations.

Businesses in India have traditionally relied on dingy, stuffy low-rise sheds known as godowns for their storage needs, but these are unsuited to the needs of foreign industrial giants whose investment Prime Minister Narendra Modi wants to lure.

So developers such as Greenbase are scouting for land nationwide, grappling with thorny acquisition issues, as they line up millions of dollars in new investment.

Prime targets are firms looking to expand manufacturing facilities beyond China as tension with the United States and other countries takes off some of its shine.

Companies in the booming e-commerce and manufacturing industries also see India as a hub for exports while looking to boost sales to industries and domestic consumers amid a population of 1.4 billion.

“We thought this is the right moment to enter India as there is a huge potential runway for growth over the next 15 to 20 years,” said Sandeep Chanda, the India managing director of one of the world’s biggest developers, US-based Panattoni.

One lure has been spanking new facilities, from ports to highways, added in an $808-billion infrastructure splurge over the last seven years, boosting connectivity and putting the spotlight on previously overlooked plots of land.

Pressmediaofindia

Pressmediaofindia